If you’re like most people, your head is spinning a little of credit card offers that come in the mail during the holiday season. It’s tough to know what’s what when it comes to all those 0% APR offers and other incentives.

One term you may have seen but don’t quite understand is “unbilled amount in Credit Card.” What does it mean? Is it a good thing or a bad thing? Can you pay it off or not?

In this article, we’ll take a comprehensive look at what an unbilled amount means for your credit card transactions and what you can do about it.

What is Unbilled Amount on Credit Card?

This is a question that many people have, but don’t know how to find the answer to. It can be confusing, especially if you are not familiar with the terminology used in the credit card industry.

We will explain what an unbilled amount means, and how you can pay any unbilled transactions that may appear on your statement.

- What is Unbilled Amount Means?

- Ways to check unbilled amounts on the credit cards

- Faq’s on Unbilled Amounts

Let’s get started!!

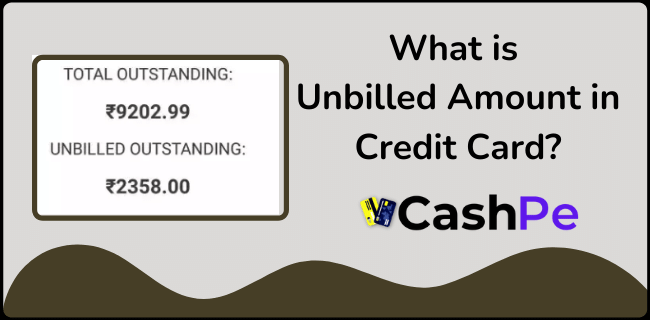

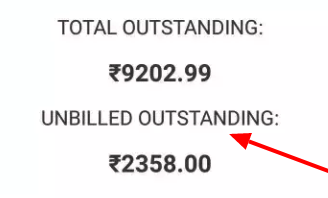

What is Unbilled Amount Means?

The transactions made up to the statement date are shown in this month’s credit card statement, and all transactions made after that are called unbilled amounts. It will be added to your next month’s bill.

For example, if you received a credit card statement on 20th December for the billing period of November 15 – December 14, then any purchases you make from December 15 to the next month’s statement date will reflect as your unbilled amount in the upcoming credit card bill.

Once you pay that total, it won’t appear on your future statements anymore. It’s only when you don’t pay what is due (including any unpaid charges) by the end of a billing period that a charge will carry over to the next month.

Ways to Check Unbilled Amounts on Credit Cards?

There are many ways in which you can check your unbilled amount. The most common way is through online banking, and several banks also offer mobile apps for this purpose. This makes it easy for you as there is no need to go out of your way just so that you can check what the amount on your credit card is.

The Most possible ways are the following:

- Online Banking or Net Banking

- Mobile Banking Apps

- Toll Free Numbers

- Contacting through Whatsapp

- SMS

- Visiting the Branch

- ATM

- Monthly Statements

These are the most possible ways to check the credit card unbilled amounts.

If you don’t have access to the internet or mobile banking, then visiting a bank branch could be another option for checking what’s due on your credit card bill.

Another way in which people tend to check their credit card unbilled amount is by making a toll-free phone call to the customer service of their respective banks.

FAQ’s on Unbilled Amounts in Credit Card

We have covered the questions which are asked most frequently. Check all those and make sure to know the answers to all the questions.

Q. What should I do if I have an unbilled amount on my statement?

A. If you have an unbilled amount, then the first thing you need to do is find out what the total amount due is. Once you have this figure, you can then work on making a payment plan so that you can clear your debt as soon as possible.

Q. Can I pay off my unbilled amount in full?

A. Yes, you can definitely choose to pay off your “unbilled amount” which is the total of all your transactions on your credit card for a particular month, minus any payments or credits you received.

Q. Do we need to pay the unbilled amount?

A. Unbilled amount means any transactions made on the credit card from the day you received your statement, but not yet processed by your bank. So it’s up to you whether you pay the unbilled amount or not.

Q. What happens if I do not pay my unbilled amount?

A. If you don’t pay your unbilled amount, then a fresh new cycle begins and the unpaid balance of the previous month will be included in the next month’s statement. And so on, until you pay it off or have it carried forward to the next cycle.

Q. Can I pay the unbilled amount on a credit card?

A. No, as the unbilled amount as per credit card is related to future transactions. You can pay your total bill or installments of installments.

Q. When to pay the unbilled amount on a credit card?

A. You can pay the unbilled amount on a credit card anytime, but ideally just before the next statement cycle begins so that there is no outstanding balance left over.

Conclusion

We hope this helps you to better understand ” Unbilled Amounts on Credit Cards”. If you have any queries or questions related to the subject, then do ask in the comment section. It will be a pleasure to give you a reply back.

If this answer is helpful, then don’t forget to share it with your friends and family. Let everyone know about ” Unbilled Amounts on Credit Cards “. Stay tuned to CashPe for more informative guides on the credit card.